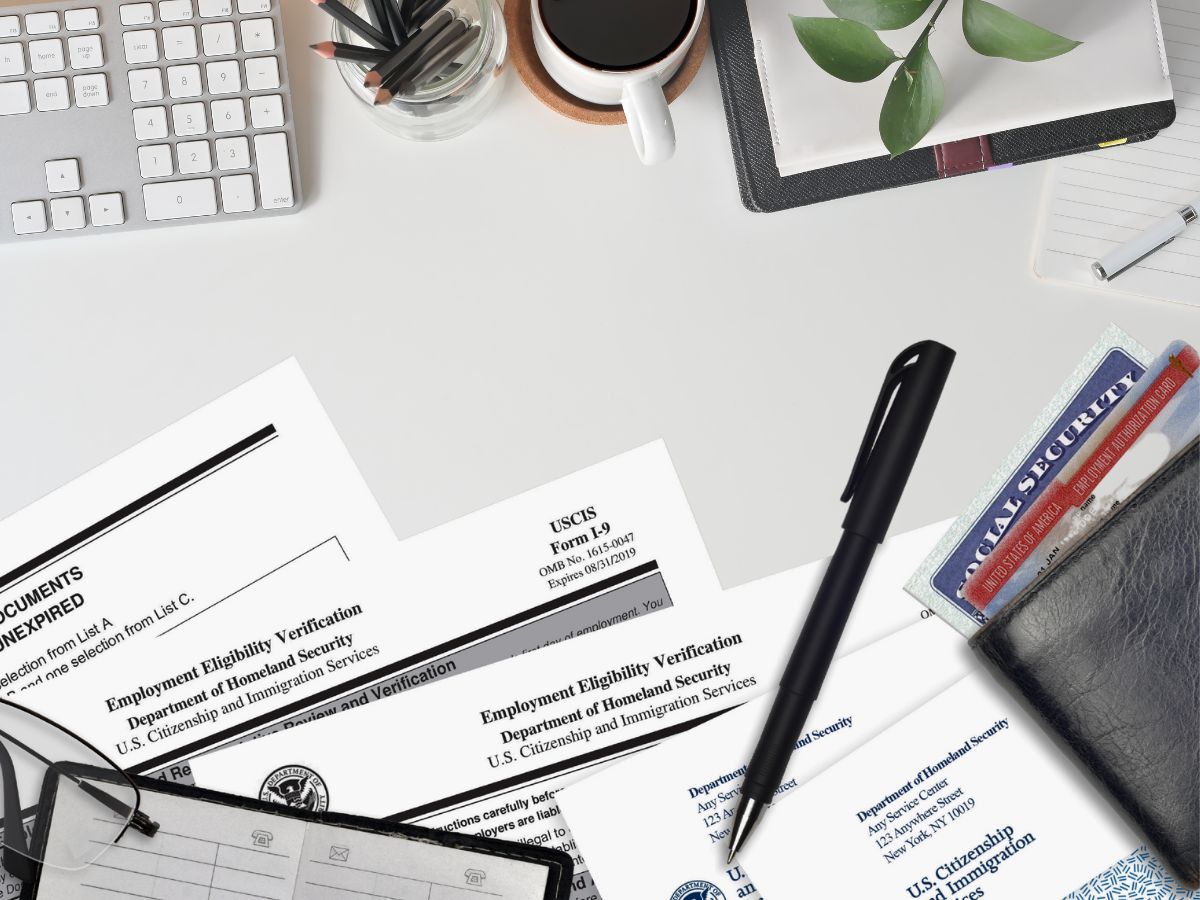

Many HR leaders don’t realize how even small paperwork mistakes on Form I-9s can snowball into substantial legal and financial consequences. As of June 28, 2024, the U.S. Department of Homeland Security increased penalties for Form I-9 violations:

- Paperwork violations: $281 to $2,789 per form

- Knowingly employing unauthorized workers (first offense): $689 to $5,579 per violation

- Second offense: $5,579 to $13,946

- Third or subsequent offenses: $8,369 to $27,894

- E-Verify failures to report final non-confirmation: $973 to $1,942 per employee

With increased enforcement from ICE (Immigration and Customs Enforcement), internal audits are no longer optional — they’re essential.

At HR Business Partners, we help clients proactively assess and improve their I-9 practices before federal inspectors come knocking. Our internal audit services help organizations:

- Identify and correct errors before an official inspection

- Ensure consistency across multiple locations and departments

- Verify use of the correct form version and processes

- Prepare HR teams for future government audits or inquiries

REAL-WORLD TIP:

Even something as minor as a missing date or incomplete signature field can trigger fines.

We’ve helped organizations discover dozens of small errors during internal audits — all corrected before they escalated. Whether you’re a small business or a multi-site employer, I-9 compliance should be part of your ongoing HR risk management plan.

Protect your organization and your workforce. Schedule a Form I-9 audit with HR Business Partners today — and turn a compliance risk into peace of mind.